- Joined

- Mar 3, 2013

- Messages

- 1,847

Rep Bank

$2,645

$2,645

User Power: 162%

[FONT=Courier New, monospace]Since there are some people who are interested in trading Forex, I have been thinking about what advice I could give them. My only qualification for giving advice, is that I have probably lost more money trading than anyone else here. So, take whatever I say with a grain of salt. As I thought about what I would suggest, I started formulating a method I want to try. [/FONT]

[FONT=Courier New, monospace]In Forex, you trade currency pairs, which is the price of one nation's money in terms of another nation's money. You can't say how much a US dollar is worth, unless you can compare it to something, like a gallon of gas, or the Euro. When you trade a currency pair, you are betting on the strength of the currencies of two nations. When you bet the EUR/USD is going to go “upâ€, you are betting the Euro will rise in value, and/or the US dollar will drop in value. [/FONT]

[FONT=Courier New, monospace]If you want to know if the US dollar is “going upâ€, you need to track at least 3 currency pairs. For example, if I want to know how “strong†the US dollar is, I need to compare it to 2 other currencies, and also compare those other currencies to each other. In Forex, you could use these currencies:[/FONT]

[FONT=Courier New, monospace]EUR/USD = Euro vs US Dollar[/FONT]

[FONT=Courier New, monospace]EUR/GBP = Euro vs Great British Pound[/FONT]

[FONT=Courier New, monospace]GBP/USD = Great British Pound vs US Dollar[/FONT]

[FONT=Courier New, monospace]Lets say all 3 of the pairs are going “upâ€, and look at what that means:[/FONT]

[FONT=Courier New, monospace]If the EUR/USD is going “upâ€, then the Euro is rising and/or the USD is falling.[/FONT]

[FONT=Courier New, monospace]If the EUR/GBP is also going “upâ€, the Euro is beating both the USD (above) and the GBP. So the EUR is indeed strong.[/FONT]

[FONT=Courier New, monospace]If the GBP is going up, then that means it is also beating the USD, and the USD is weak.[/FONT]

[FONT=Courier New, monospace]So we know the EUR is strong, and the USD is weak. The best single trade would be to bet the EUR/USD is going to go “upâ€.[/FONT]

[FONT=Courier New, monospace]In the above example, if the GBP/USD was falling, you would have:[/FONT]

[FONT=Courier New, monospace]EUR > USD (rising EUR/USD)[/FONT]

[FONT=Courier New, monospace]EUR > GBP (rising EUR/GBP)[/FONT]

[FONT=Courier New, monospace]GBP < USD (falling GBP/USD)[/FONT]

[FONT=Courier New, monospace]It would mean:[/FONT]

[FONT=Courier New, monospace]The EUR is strong because it is beating both the USD and GBP.[/FONT]

[FONT=Courier New, monospace]The GBP is weak because it is losing to both the EUR and USD.[/FONT]

[FONT=Courier New, monospace]The best single trade would be betting the EUR/GBP will go “upâ€.[/FONT]

[FONT=Courier New, monospace]If you wanted to diversify, you could put 50% of your bet on the best trade, and 25% on each supporting trade. From the first example, you could bet:[/FONT]

[FONT=Courier New, monospace]EUR/USD = bet 50% it is going up, since EUR is strong and USD is weak[/FONT]

[FONT=Courier New, monospace]EUR/GBP = bet 25% it is going up, since EUR is strong[/FONT]

[FONT=Courier New, monospace]GBP/USD = bet 25% it is going up, since USD is weak[/FONT]

[FONT=Courier New, monospace]From the second example:[/FONT]

[FONT=Courier New, monospace]EUR/USD = bet 25% it is going up, since EUR is strong[/FONT]

[FONT=Courier New, monospace]EUR/GBP = bet 50% it is going up, since EUR is strong and GBP is weak[/FONT]

[FONT=Courier New, monospace]GBP/USD = bet 25% it is going down, since GBP is weak[/FONT]

[FONT=Courier New, monospace]In trading, you normally want to have a way to sit on the sidelines when you are confused, but with Forex you cannot really do that since you are trading money itself. If you “go to cashâ€, you are still betting on some nation's currency (probably the USD if you are American). You are taking a position by virtue of having money. Because of this, this method does not include a timeout mechanism.[/FONT]

[FONT=Courier New, monospace]Above, when I mentioned investing 100% of “your betâ€, this is assumed to be something like 2% of your account size, not 100% of your account size. Putting “50% of your bet in to the single best trade†would be putting 1% of your account in to it. A winning trade would be added to it, probably by an additional 1% per period.[/FONT]

[FONT=Courier New, monospace]To decide trading frequency, I prefer to let that be dictated by the expected “run†of the trades. I don't usually use indicators, but in this test case I will probably use the Heikin-Ashi indicator on weekly Forex closing prices. The big gains are made on the trades that are allowed to trend, and weekly Forex data trends a lot better than daily data. Adding to a position each week would allow for pyramiding winning positions.[/FONT]

[FONT=Courier New, monospace]I have not worked out how to deal with the extreme leverage in Forex combined with the long multi-week hold periods, so I will have to just try it using minimal leverage and small bet sizes. I also ordered some back testing data which I will analyze to see if things still look promising.[/FONT]

[FONT=Courier New, monospace]I certainly don't suggest anyone try this approach until I see how I do, but I mention it because it is simple and contains a few important things:[/FONT]

[FONT=Courier New, monospace]1) It diversifies through time by investing 1-2% at a time[/FONT]

[FONT=Courier New, monospace]2) It diversifies through breadth by trading 3 pairs at a time[/FONT]

[FONT=Courier New, monospace]3) It uses a confirmation method (figuring out the strong and weak)[/FONT]

[FONT=Courier New, monospace]4) It does not over-trade because positions are adjusted weekly[/FONT]

[FONT=Courier New, monospace]5) It allows pyramiding (adding to) winning positions[/FONT]

[FONT=Courier New, monospace]6) It is always in the market, because it has to be[/FONT]

[FONT=Courier New, monospace]7) It is simple, it only uses the previous week's indicator[/FONT]

[FONT=Courier New, monospace]8) It is slow enough to not interest the day trading crowd

[/FONT]

[FONT=Courier New, monospace]In Forex, you trade currency pairs, which is the price of one nation's money in terms of another nation's money. You can't say how much a US dollar is worth, unless you can compare it to something, like a gallon of gas, or the Euro. When you trade a currency pair, you are betting on the strength of the currencies of two nations. When you bet the EUR/USD is going to go “upâ€, you are betting the Euro will rise in value, and/or the US dollar will drop in value. [/FONT]

[FONT=Courier New, monospace]If you want to know if the US dollar is “going upâ€, you need to track at least 3 currency pairs. For example, if I want to know how “strong†the US dollar is, I need to compare it to 2 other currencies, and also compare those other currencies to each other. In Forex, you could use these currencies:[/FONT]

[FONT=Courier New, monospace]EUR/USD = Euro vs US Dollar[/FONT]

[FONT=Courier New, monospace]EUR/GBP = Euro vs Great British Pound[/FONT]

[FONT=Courier New, monospace]GBP/USD = Great British Pound vs US Dollar[/FONT]

[FONT=Courier New, monospace]Lets say all 3 of the pairs are going “upâ€, and look at what that means:[/FONT]

[FONT=Courier New, monospace]If the EUR/USD is going “upâ€, then the Euro is rising and/or the USD is falling.[/FONT]

[FONT=Courier New, monospace]If the EUR/GBP is also going “upâ€, the Euro is beating both the USD (above) and the GBP. So the EUR is indeed strong.[/FONT]

[FONT=Courier New, monospace]If the GBP is going up, then that means it is also beating the USD, and the USD is weak.[/FONT]

[FONT=Courier New, monospace]So we know the EUR is strong, and the USD is weak. The best single trade would be to bet the EUR/USD is going to go “upâ€.[/FONT]

[FONT=Courier New, monospace]In the above example, if the GBP/USD was falling, you would have:[/FONT]

[FONT=Courier New, monospace]EUR > USD (rising EUR/USD)[/FONT]

[FONT=Courier New, monospace]EUR > GBP (rising EUR/GBP)[/FONT]

[FONT=Courier New, monospace]GBP < USD (falling GBP/USD)[/FONT]

[FONT=Courier New, monospace]It would mean:[/FONT]

[FONT=Courier New, monospace]The EUR is strong because it is beating both the USD and GBP.[/FONT]

[FONT=Courier New, monospace]The GBP is weak because it is losing to both the EUR and USD.[/FONT]

[FONT=Courier New, monospace]The best single trade would be betting the EUR/GBP will go “upâ€.[/FONT]

[FONT=Courier New, monospace]If you wanted to diversify, you could put 50% of your bet on the best trade, and 25% on each supporting trade. From the first example, you could bet:[/FONT]

[FONT=Courier New, monospace]EUR/USD = bet 50% it is going up, since EUR is strong and USD is weak[/FONT]

[FONT=Courier New, monospace]EUR/GBP = bet 25% it is going up, since EUR is strong[/FONT]

[FONT=Courier New, monospace]GBP/USD = bet 25% it is going up, since USD is weak[/FONT]

[FONT=Courier New, monospace]From the second example:[/FONT]

[FONT=Courier New, monospace]EUR/USD = bet 25% it is going up, since EUR is strong[/FONT]

[FONT=Courier New, monospace]EUR/GBP = bet 50% it is going up, since EUR is strong and GBP is weak[/FONT]

[FONT=Courier New, monospace]GBP/USD = bet 25% it is going down, since GBP is weak[/FONT]

[FONT=Courier New, monospace]In trading, you normally want to have a way to sit on the sidelines when you are confused, but with Forex you cannot really do that since you are trading money itself. If you “go to cashâ€, you are still betting on some nation's currency (probably the USD if you are American). You are taking a position by virtue of having money. Because of this, this method does not include a timeout mechanism.[/FONT]

[FONT=Courier New, monospace]Above, when I mentioned investing 100% of “your betâ€, this is assumed to be something like 2% of your account size, not 100% of your account size. Putting “50% of your bet in to the single best trade†would be putting 1% of your account in to it. A winning trade would be added to it, probably by an additional 1% per period.[/FONT]

[FONT=Courier New, monospace]To decide trading frequency, I prefer to let that be dictated by the expected “run†of the trades. I don't usually use indicators, but in this test case I will probably use the Heikin-Ashi indicator on weekly Forex closing prices. The big gains are made on the trades that are allowed to trend, and weekly Forex data trends a lot better than daily data. Adding to a position each week would allow for pyramiding winning positions.[/FONT]

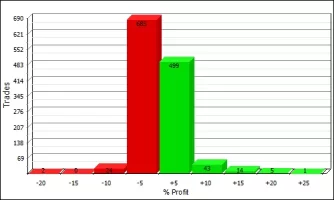

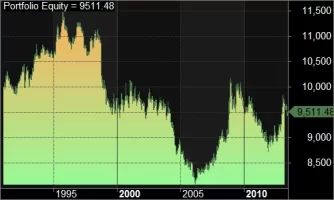

[FONT=Courier New, monospace]I have not worked out how to deal with the extreme leverage in Forex combined with the long multi-week hold periods, so I will have to just try it using minimal leverage and small bet sizes. I also ordered some back testing data which I will analyze to see if things still look promising.[/FONT]

[FONT=Courier New, monospace]I certainly don't suggest anyone try this approach until I see how I do, but I mention it because it is simple and contains a few important things:[/FONT]

[FONT=Courier New, monospace]1) It diversifies through time by investing 1-2% at a time[/FONT]

[FONT=Courier New, monospace]2) It diversifies through breadth by trading 3 pairs at a time[/FONT]

[FONT=Courier New, monospace]3) It uses a confirmation method (figuring out the strong and weak)[/FONT]

[FONT=Courier New, monospace]4) It does not over-trade because positions are adjusted weekly[/FONT]

[FONT=Courier New, monospace]5) It allows pyramiding (adding to) winning positions[/FONT]

[FONT=Courier New, monospace]6) It is always in the market, because it has to be[/FONT]

[FONT=Courier New, monospace]7) It is simple, it only uses the previous week's indicator[/FONT]

[FONT=Courier New, monospace]8) It is slow enough to not interest the day trading crowd

[/FONT]

Dislike ads? Become a Fastlane member:

Subscribe today and surround yourself with winners and millionaire mentors, not those broke friends who only want to drink beer and play video games. :-)

Membership Required: Upgrade to Expose Nearly 1,000,000 Posts

Ready to Unleash the Millionaire Entrepreneur in You?

Become a member of the Fastlane Forum, the private community founded by best-selling author and multi-millionaire entrepreneur MJ DeMarco. Since 2007, MJ DeMarco has poured his heart and soul into the Fastlane Forum, helping entrepreneurs reclaim their time, win their financial freedom, and live their best life.

With more than 39,000 posts packed with insights, strategies, and advice, you’re not just a member—you’re stepping into MJ’s inner-circle, a place where you’ll never be left alone.

Become a member and gain immediate access to...

- Active Community: Ever join a community only to find it DEAD? Not at Fastlane! As you can see from our home page, life-changing content is posted dozens of times daily.

- Exclusive Insights: Direct access to MJ DeMarco’s daily contributions and wisdom.

- Powerful Networking Opportunities: Connect with a diverse group of successful entrepreneurs who can offer mentorship, collaboration, and opportunities.

- Proven Strategies: Learn from the best in the business, with actionable advice and strategies that can accelerate your success.

"You are the average of the five people you surround yourself with the most..."

Who are you surrounding yourself with? Surround yourself with millionaire success. Join Fastlane today!

Join Today