- Joined

- Feb 2, 2016

- Messages

- 66

Rep Bank

$1,180

$1,180

User Power: 418%

This relates to the Money System mentioned towards the back of Unscripted , and how to perform due diligence on quality of cash flows.

This will compare two examples (at least one is mentioned in the book): BlackRock MuniYield Arizona (MZA) and Aberdeen Asia-Pacific Income Fund Inc (FAX). Both are closed end funds that pay dividends monthly.

My question relates to the different types of distributions and whether this can give insight to the overall health of the fund.

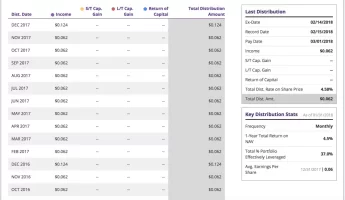

This first screenshot is the allocation of monthly distributions (dividends) to the shareholders of FAX. There's a balance of income, gains, and return of capital.

The second screenshot is the allocation of MZA. All of the distribution amount is considered Income.

From a tax perspective, return of capital is great since it's typically tax free (i.e. your own capital being returned to you).

However, seeing so much capital being returned in FAX makes me question the overall health of the fund. Is it not performing as well as anticipated? Is the reason so much of this is "return of capital" that they are not making as much profit as needed?

Conversely, seeing all of MZA's distributions categorized as Income makes me conclude that it is doing as well as, or better than, expected. As in, all of its holdings are performing very well so there's no need to return any capital.

I don't have much experience with this so I may be completely missing something.

Anyone more experienced than me care to weigh in?

This will compare two examples (at least one is mentioned in the book): BlackRock MuniYield Arizona (MZA) and Aberdeen Asia-Pacific Income Fund Inc (FAX). Both are closed end funds that pay dividends monthly.

My question relates to the different types of distributions and whether this can give insight to the overall health of the fund.

This first screenshot is the allocation of monthly distributions (dividends) to the shareholders of FAX. There's a balance of income, gains, and return of capital.

The second screenshot is the allocation of MZA. All of the distribution amount is considered Income.

From a tax perspective, return of capital is great since it's typically tax free (i.e. your own capital being returned to you).

However, seeing so much capital being returned in FAX makes me question the overall health of the fund. Is it not performing as well as anticipated? Is the reason so much of this is "return of capital" that they are not making as much profit as needed?

Conversely, seeing all of MZA's distributions categorized as Income makes me conclude that it is doing as well as, or better than, expected. As in, all of its holdings are performing very well so there's no need to return any capital.

I don't have much experience with this so I may be completely missing something.

Anyone more experienced than me care to weigh in?

Dislike ads? Become a Fastlane member:

Subscribe today and surround yourself with winners and millionaire mentors, not those broke friends who only want to drink beer and play video games. :-)

Attachments

Membership Required: Upgrade to Expose Nearly 1,000,000 Posts

Ready to Unleash the Millionaire Entrepreneur in You?

Become a member of the Fastlane Forum, the private community founded by best-selling author and multi-millionaire entrepreneur MJ DeMarco. Since 2007, MJ DeMarco has poured his heart and soul into the Fastlane Forum, helping entrepreneurs reclaim their time, win their financial freedom, and live their best life.

With more than 39,000 posts packed with insights, strategies, and advice, you’re not just a member—you’re stepping into MJ’s inner-circle, a place where you’ll never be left alone.

Become a member and gain immediate access to...

- Active Community: Ever join a community only to find it DEAD? Not at Fastlane! As you can see from our home page, life-changing content is posted dozens of times daily.

- Exclusive Insights: Direct access to MJ DeMarco’s daily contributions and wisdom.

- Powerful Networking Opportunities: Connect with a diverse group of successful entrepreneurs who can offer mentorship, collaboration, and opportunities.

- Proven Strategies: Learn from the best in the business, with actionable advice and strategies that can accelerate your success.

"You are the average of the five people you surround yourself with the most..."

Who are you surrounding yourself with? Surround yourself with millionaire success. Join Fastlane today!

Join Today